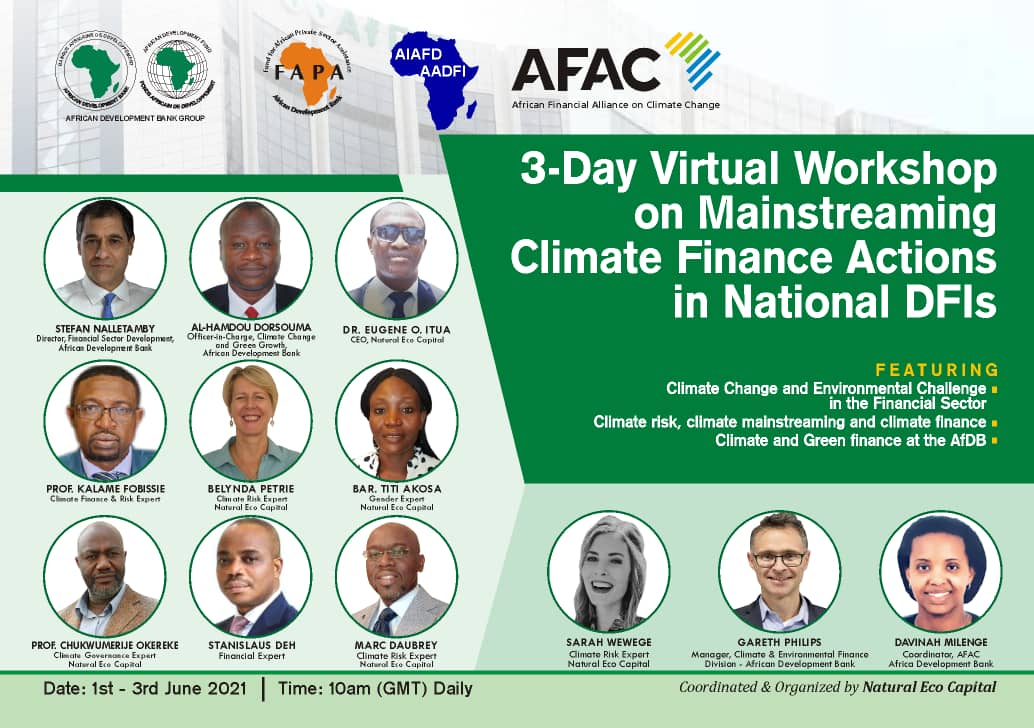

The African Development Bank and the Association of African Development Finance Institutions AADFI jointly hosted a 3-day virtual workshop to train development finance experts in Africa on climate finance action strategy and management.

The training aimed to equip participants, particularly those from the financial and private sectors, with knowledge on how to scale up climate actions. Over 200 participants were able to gain a deeper understanding of the roles of national development finance institutions in climate risk management.

In his opening remarks, Al-Hamdou Dorsouma, Officer-in-Charge of Climate Change and Green Growth at the African Development Bank, stated: “This initiative and the Bank’s activities in mainstreaming climate finance is to strengthen African countries’ drive to realize their Nationally Determined Contributions (NDCs) goals. It will also boost partnerships and knowledge sharing on how to pull finance for various climate action projects.”

Davinah Milenge, Coordinator of the African Financial Alliance on Climate Change AFAC spoke about managing climate risks and the role of the AFAC. “The pan-African alliance aims to put the financial sector at the centre of climate action in Africa. AFAC brings together Africa’s key financial institutions, including central banks, insurance companies, sovereign wealth and pension funds, stock exchanges, as well as commercial and development banks, to mobilize private capital towards continent-wide low-carbon and climate-resilient development.”

There were presentations and demonstrations of two business screening toolkits – the climate risk and opportunity toolkit and the business carbon footprints toolkit – which were developed by experts from Natural Eco Capital which coordinated the workshop.

Dr Eugene Itua, Chief Executive Officer of Natural Eco Capital, spoke on the importance of environmental, social and governance criteria in the financial sector. He explained how this aligns climate risk with the Paris Agreement.

Stefan Nalletamby, the Bank’s Director of Financial Sector Development, noted that climate change impacts were reshaping the way people viewed the environment and business. He said the workshop would provide delegates with enhanced knowledge of climate change-related risks, as well as tools to mitigate its impacts and an understanding of how to mobilize climate finance for organizational operations.

Nalletamby also announced that both the Bank’s Climate Change and Financial Sector Development teams are working together to develop a financial sector credit facility to scale up financial flows to green SMEs through financial intermediaries across the continent.

Patricia Ojangole, the AADFI’s first Vice Chairperson and Managing Director of the Uganda Development Bank, said while climate change causes major risks with cross-boundary effects, it holds opportunities, especially development finance institutions. Consequently, there is a need to prepare for its negative impacts and work to significantly mitigate its risks. She stressed that the gap experienced by African countries to solve related impacts could be bridged through adequate funding and skills in climate finance, which can be aided by scaling up the capacity building.